Table of Contents

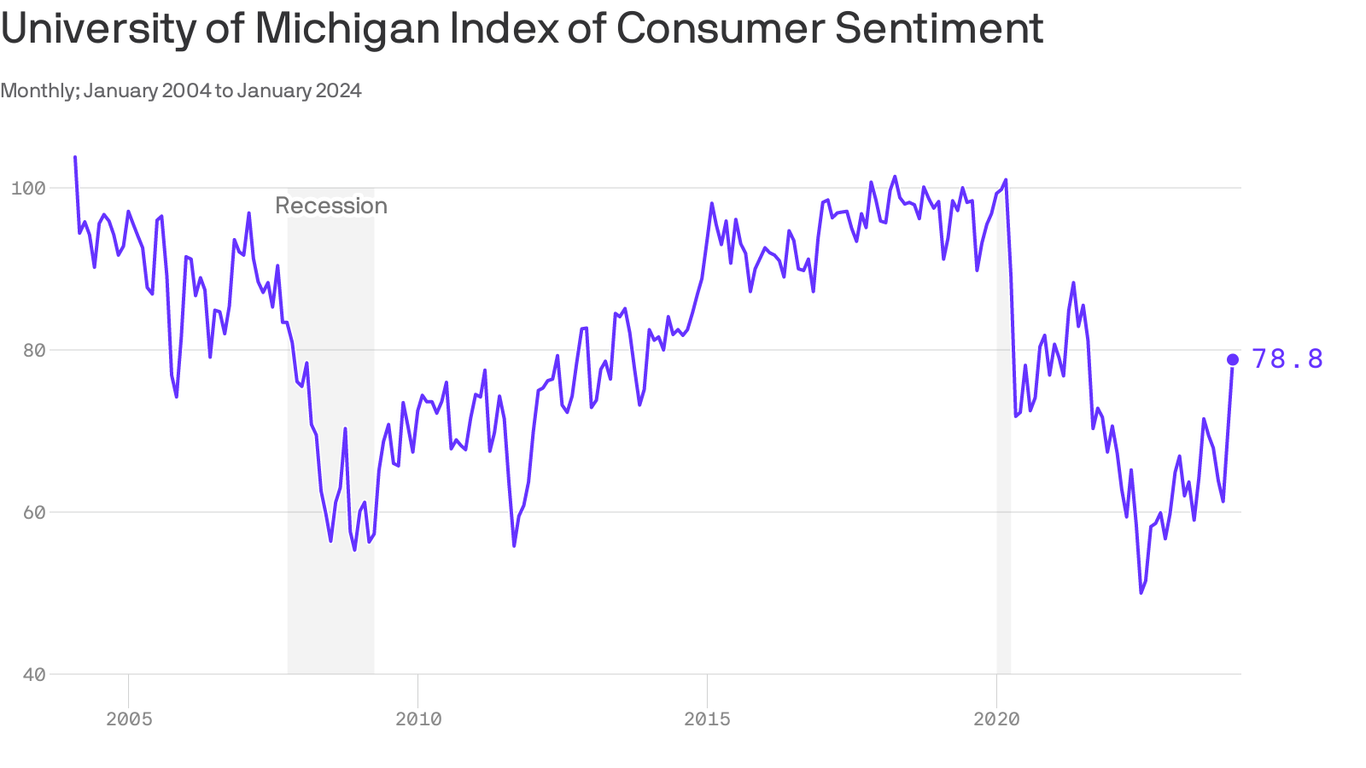

- U.S. consumer sentiment is rapidly improving

- Customer Sentiment Analysis: What Is It and How To Collect Data for It

- Consumer sentiment inches lower for April: UMich survey

- US consumer sentiment improved in January

- Michigan Consumer Sentiment: July Final Slightly Worse Than Expected ...

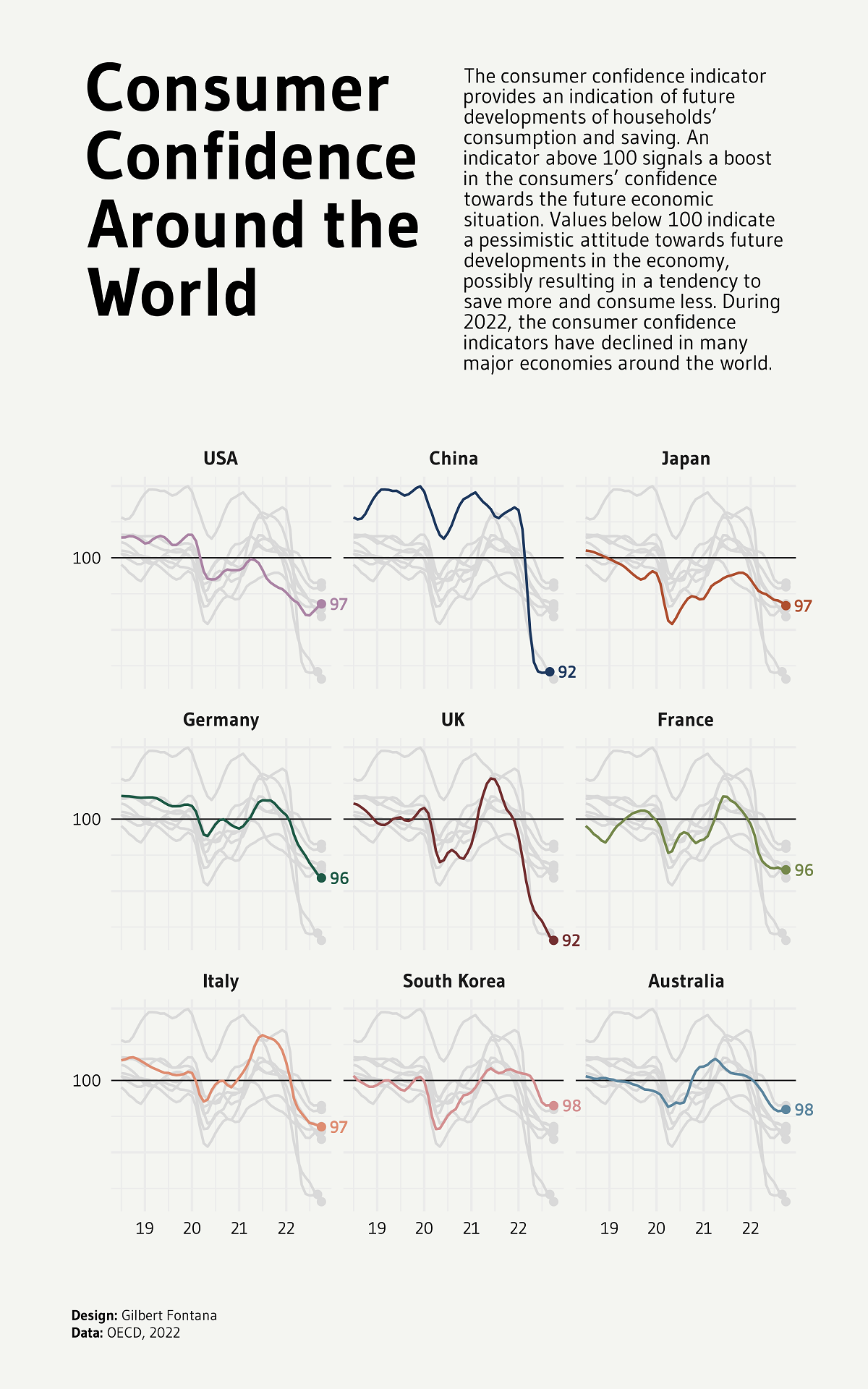

- US Economic Concerns Reflect in Consumer Sentiment

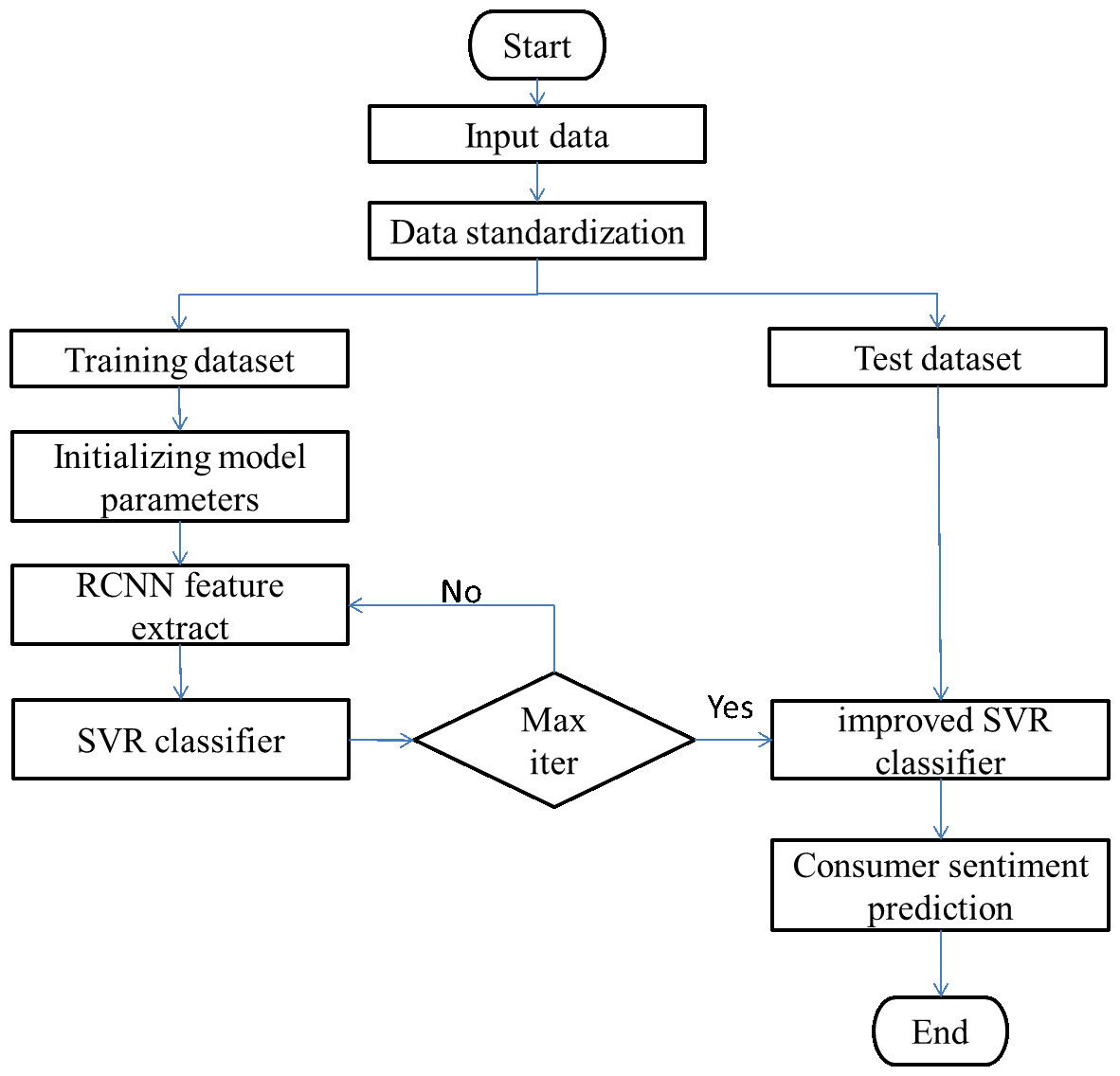

- A consumer emotion analysis system based on support vector regression ...

- Consumer Sentiment

- US Consumer Sentiment Declines for Fourth Consecutive Month in November

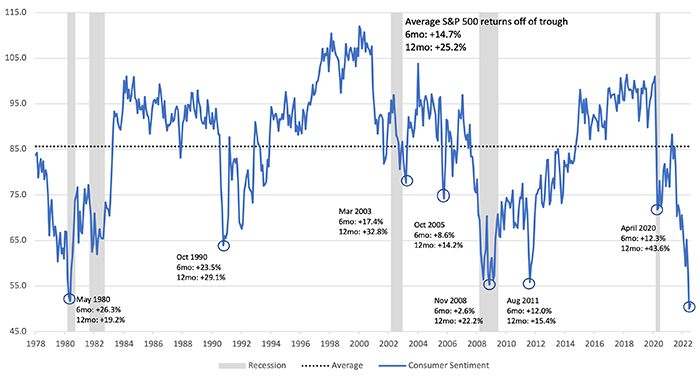

- Consumer sentiment and forward market performance

Inflation Fears on the Rise

Key Factors Contributing to Inflation

- Supply Chain Disruptions: Ongoing supply chain issues, exacerbated by the pandemic, have led to shortages and price hikes for essential goods.

- Rising Energy Costs: Increased energy prices are having a knock-on effect on the cost of production, transportation, and ultimately, consumer prices.

- Monetary Policy: The expansionary monetary policies implemented during the pandemic have led to an increase in money supply, contributing to inflationary pressures.

Impact on Consumer Behavior

- Reduced Spending: Consumers are cutting back on non-essential expenses, opting for savings and debt repayment instead.

- Shift to Value-Based Purchasing: Households are becoming more price-conscious, seeking value for money and opting for cheaper alternatives.

- Increased Price Sensitivity: Consumers are becoming more sensitive to price changes, with even small increases leading to a decline in demand.

- Monetary Policy Adjustments: Central banks can adjust interest rates to curb inflationary pressures.

- Fiscal Policy Interventions: Governments can implement policies to support low-income households and promote economic growth.

- Supply Chain Diversification: Businesses can diversify their supply chains to reduce reliance on single sources and mitigate the impact of disruptions.