Table of Contents

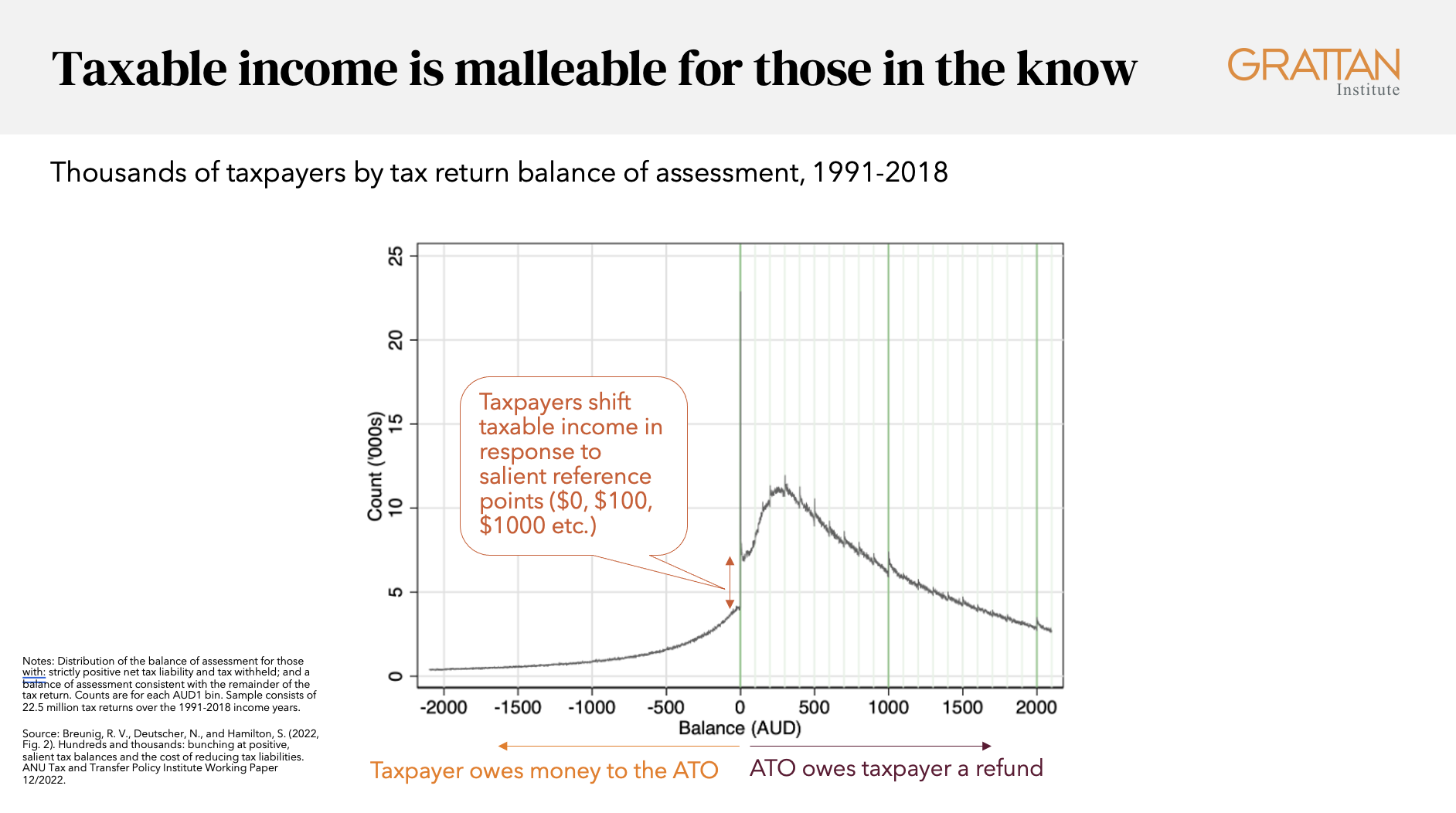

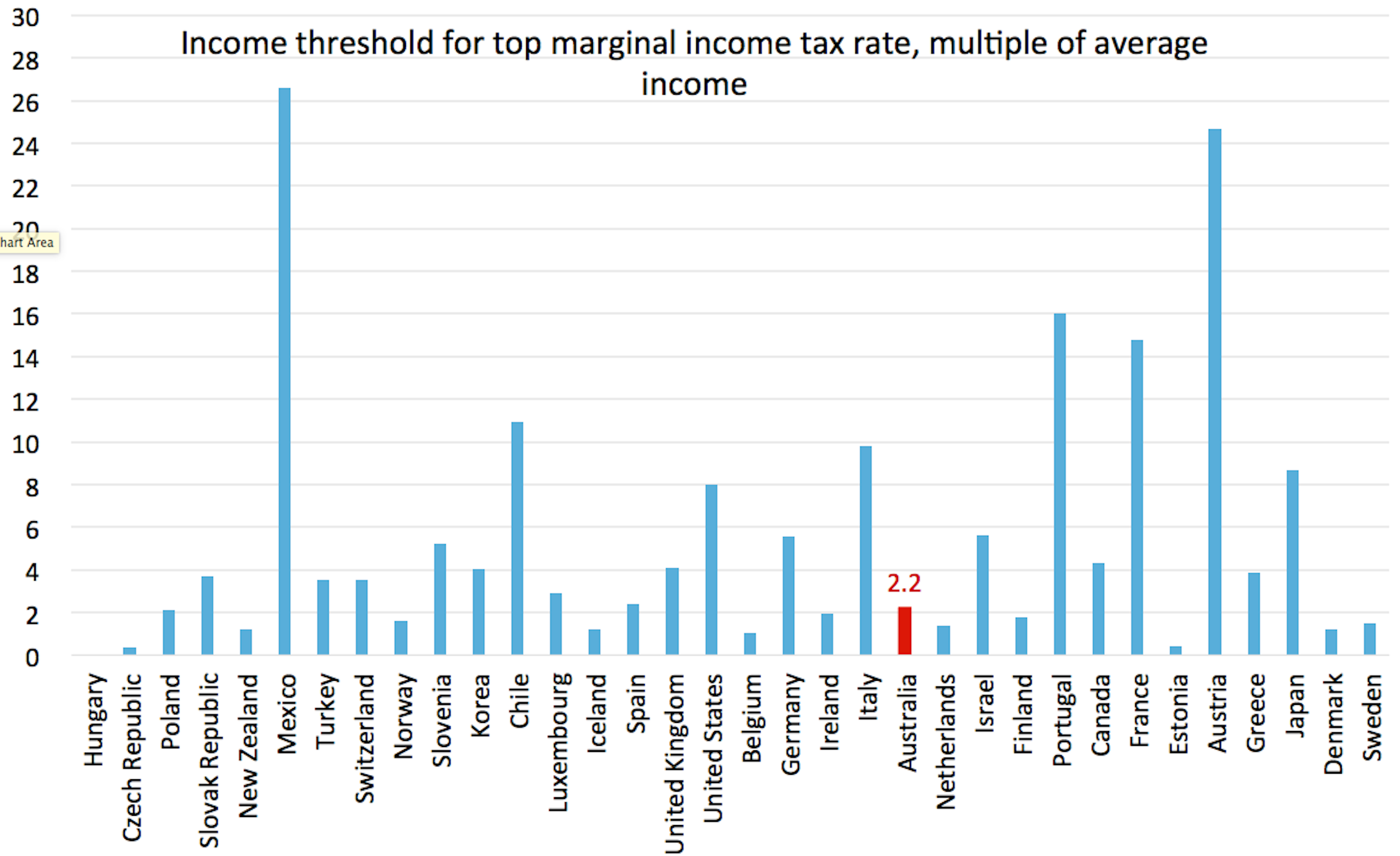

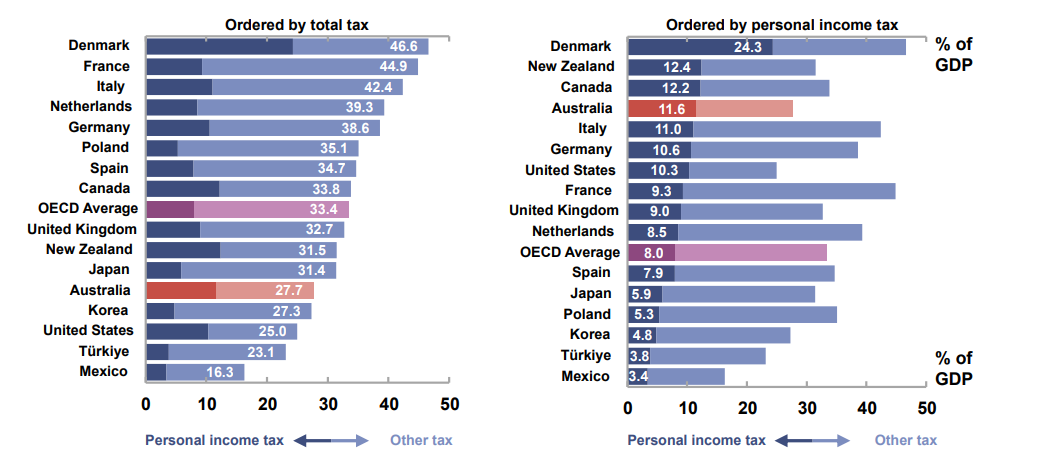

- Tax reform in Australia: an impossible dream? - Grattan Institute

- Full response from the AiGroup for a FactCheck on how Australia's top ...

- What Are The Australian Income Tax Rates For 2024 25 - Printable ...

- Australian income tax brackets and rates (2024-25 and previous years)

- Tax Planning is for Individuals also…not just for business

- Individuals statistics | Australian Taxation Office

- Australian Income Tax Explained How Tax Brackets Work Tax Basics Connor ...

- How Australian Tax Brackets Work in 2025 | Income Tax Explained For ...

- Australia’s tax rates: Top earners shoulder more of the tax burden

- Trends in personal income tax | pbo

Understanding the 2025 Australian Tax Changes

Implications for Individuals

Implications for Businesses

For businesses, especially small and medium-sized enterprises (SMEs), the changes could be significant: - Competitiveness: A reduced corporate tax rate could enhance the competitiveness of Australian businesses in the global market. - Investment and Growth: More favorable tax conditions could encourage investment, leading to business expansion and job creation. - Compliance: Businesses will need to ensure they understand and comply with any new tax laws and regulations, which could involve updating accounting systems and processes.